Unlock Your Financial Potential

Independent Wealth Manager

FormInvest AG is an independent wealth management boutique, established in 2012 and based in Zurich.

We provide tailored discretionary and advisory solutions to High and Ultra-High Net Worth Individuals, as well as corporates in the Middle East and Switzerland.

Our investment philosophy focuses on wealth preservation strategies through broad diversification, prudence and discipline while taking a long-term approach.

We offer clients the highest level of investment advice and professional support by combining passion, experience, ethics and deep investment knowledge.

Pierre-Yves Formaz, founder & CIO, manages discretionary solutions on behalf of the firm’s clients since 2013. He was previously at UBS for 20+ years as an investment advisor covering High and Ultra-High Net Worth Individuals from the Middle East, Switzerland and Europe. Pierre-Yves is a CFA® Charterholder and a Swiss-certified Banking Expert.

We are licensed and regulated by the Swiss Financial Market Authority (FINMA) and monitored by the supervisory organization FINcontrol Suisse AG.

Why FormInvest?

Transparency

Complete transparency on investment risks and costs to the client. We strive to optimize investment costs; fund expenses and transaction fees, in addition to offering a fee structure tailored to the client’s wishes. All figures and data are GIPS compliant & independently verified by PwC.

MENA Focus

Our Swiss & Middle Eastern heritage grants us a natural advantage, as we possess a deep understanding of the local culture, business practices and regulatory environment. This allows us to navigate complexities efficiently and deliver a personalized client service from Switzerland.

Best-in-Class Product Selection

We have no vested interest in recommending one product over another. This allows us to select the most suitable, best performing and cost-efficient products for our clients.

Independent Investment Advice

We have a fiduciary duty to deliver unbiased investment advice, ensuring that our clients receive the most appropriate investment solutions. Thanks to our in-depth market analysis we optimize portfolio performance and navigate complex financial landscapes with confidence.

Global Market Research

We conduct comprehensive market research across a broad range of providers to maintain our independent and impartial views on market conditions.

Expertise and Specialization

Our knowledge and experience in wealth preservation strategies provides clients with access to high-quality, superior risk-adjusted investment portfolios.

Our Happy Clients

CEO

These prestigious awards recognize and reaffirm our value and dedication to our clients, prospects and partners.

CEO

They encourage us to continue delivering superior investment solutions and measuring our success through client satisfaction.

Investment Philosopy

At the core of our philosophy lies a dedication to service our clients, addressing their immediate and future objectives.

We can advise on client assets deposited across various banks, allowing for a holistic and comprehensive management of the client’s wealth.

In doing so our investment advice and solutions are seamlessly integrated within the client’s overall financial situation.

- Consider the client first and foremost as a valued partner, servicing with the highest level of confidentiality and personal attention.

- Align the best interests of the client with the best interests of the firm, avoiding any conflicts of interest.

- Passionate about understanding client situation, needs and expectations to provide tailored wealth management solutions.

- Develop a financial plan focusing on the client’s long-term goals while meeting short-term requirements.

- Access to all asset classes through investment funds reserved only to institutional investors.

- Minimize investment risk through optimal diversification and constant monitoring of investments.

- Focus on cost-efficient investment products, reducing investment costs for the client.

- Transparent and flexible fees chosen by the client.

Investment Solutions

Wealth preservation strategies based on two core pillars.

The combination of discretionary and advisory portfolios allows for a holistic approach to managing your assets.

Discretionary Solutions

- Actively managed multi-asset discretionary portfolios: Income, Yield, Balanced, Growth, Equity

- Tailored to client needs and recommendations.

- Access to best-in-class products and managers.

- Thorough due diligence of market and strategy risk.

- Ongoing monitoring of managers and strategies.

- Proactive rebalancing of portfolio holdings.

- Dedicated advisor for any portfolio questions.

- Comprehensive monthly performance report.

- Available in USD, EUR and CHF.

Advisory Solutions

- Active capital deployment into niche, tactical market opportunities across all asset classes.

- Take advantage of dislocation opportunities.

- Access to exclusive investment recommendations.

- Potential to amplify discretionary portfolio returns.

- Ongoing monitoring of portfolio securities.

- Proactive rebalancing of portfolio holdings.

- Dedicated advisor for any portfolio questions.

- Comprehensive monthly performance report.

- Available in all major currencies.

We highly value transparency and for this reason we are one of only three dozen firms in Switzerland, that claims compliance with the Global Investment Performance Standards (GIPS®) and has been independently verified for the periods January 1st, 2016, till December 31st, 2023. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or the quality of he content contained herein. To receive a GIPS compliance presentation and/or our firm’s list of composite descriptions please email your request to info@forminvest.com.

Working with FormInvest

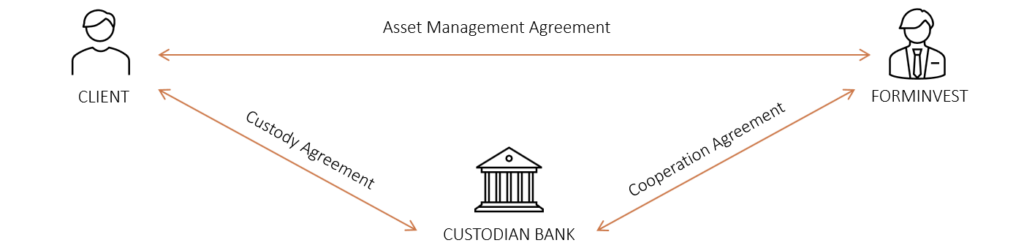

Custodian Bank

Choose a custodian bank among our partner banks to hold your assets.

Account Opening

Open an account with the bank's External Asset Manager desk and appoint FormInvest as Limited Power of Attorney.

Portfolio Design

Construct Discretionary and Advisory Portfolios, deploy capital over time into selected strategies.

Portfolio Review

Monthly portfolio reviews and market updates, constant monitoring of your investment portfolios.

FormInvest can also advise with a Limited Power of Attorney on any of your existing private banking relationships.

Award-Winning Wealth Manager

In the past years FormInvest was awarded with the following awards:

Annual WealthBriefing Award 2023 for Swiss External Asset Managers, in the following categories:

- Servicing MENA Clients

- Fund Selection/Asset Allocation Offering

Annual WealthBriefing MENA Award 2023, in the following category:

- Investment Process

Wealth & Finance International Fund Awards 2023, in the following category:

- Most Innovative Wealth Management Boutique – Switzerland

The WealthBriefing Wealth for Good Awards 2024, in the following categories:

- Investment Performance (Global Reach)

- Investment Methodology (Europe)

“These prestigious awards recognize and reaffirm our value and dedication to our clients, prospects and partners.”

“They encourage us to continue delivering superior investment solutions and measuring our success through client satisfaction.”

– Pierre-Yves Formaz, Chairman & Managing Partner

Meet the Team

Pierre-Yves Formaz, CFA

Chairman & Managing Partner

Chief Investment Officer

Sohaila Elshater

Managing Director

Chief Operating Officer

Nada Saoudi

Associate Director

Investment Officer

Liza Ragheb

Senior Representative

Pierre-Alain Lapaire

Board Member